Self-employment earnings loss Note If you have a section 179 deduction or any partner-level deductions see the Partner s Instructions before completing Schedule SE. Tax basis GAAP Section 704 b book Other explain M Self-employment earnings loss Did the partner contribute property with a built-in gain or loss For IRS Use Only K Yes No If Yes attach statement see instructions For Paperwork Reduction Act Notice see Instructions for Form 1065. Other deductions A Cash contributions 50 C Noncash contributions 50 E Capital gain property to a 50 Instructions organization 30 G Contributions 100 H Investment interest expense Form 4952 line 1 I Deductions royalty income J Section 59 e 2 expenditures K Deductions portfolio 2 floor M Amounts paid for medical insurance Schedule A line 1 or Form 1040 line 29 N Educational assistance benefits O Dependent care benefits Form 2441 line 12 P Preproductive period expenses Q Commercial revitalization deduction See Form 8582 instructions from rental real estate activities R Pensions and IRAs S Reforestation expense deduction T Domestic production activities information See Form 8903 instructions U Qualified production activities income Form 8903 line 7b V Employer s Form W-2 wages Form 8903 line 17 14.

#K1 1065 tax form code

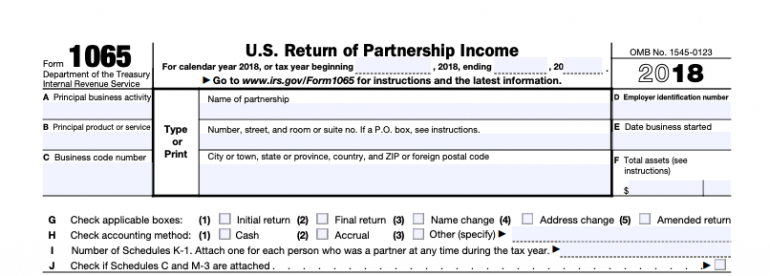

651117 Final K-1 Schedule K-1 Form 1065 Department of the Treasury Internal Revenue Service Part III Partner s Share of Current Year Income Deductions Credits and Other Items Other net rental income loss Guaranteed payments Interest income Ordinary dividends 6b B 6a A Net rental real estate income loss / ending Qualified dividends Alternative minimum tax AMT items Tax-exempt income and nondeductible expenses Distributions Other information Collectibles 28 gain loss Unrecaptured section 1250 gain Net section 1231 gain loss Other income loss Section 179 deduction Information About the Partner Net long-term capital gain loss Check if this is a publicly traded partnership PTP Net short-term capital gain loss 9a IRS Center where partnership filed return Royalties F Foreign transactions Partnership s name address city state and ZIP code Part II E 9c D Credits 9b C Partner s Share of Income Deductions See back of form and separate instructions. passive or nonpassive and enter on your return as follows.

+15+NTTC+Training+–+2015.jpg)

For detailed reporting and filing information see the separate Partner s Instructions for Schedule K-1 and the instructions for your income tax return.

11394R Page This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040.

0 kommentar(er)

0 kommentar(er)